회사소개

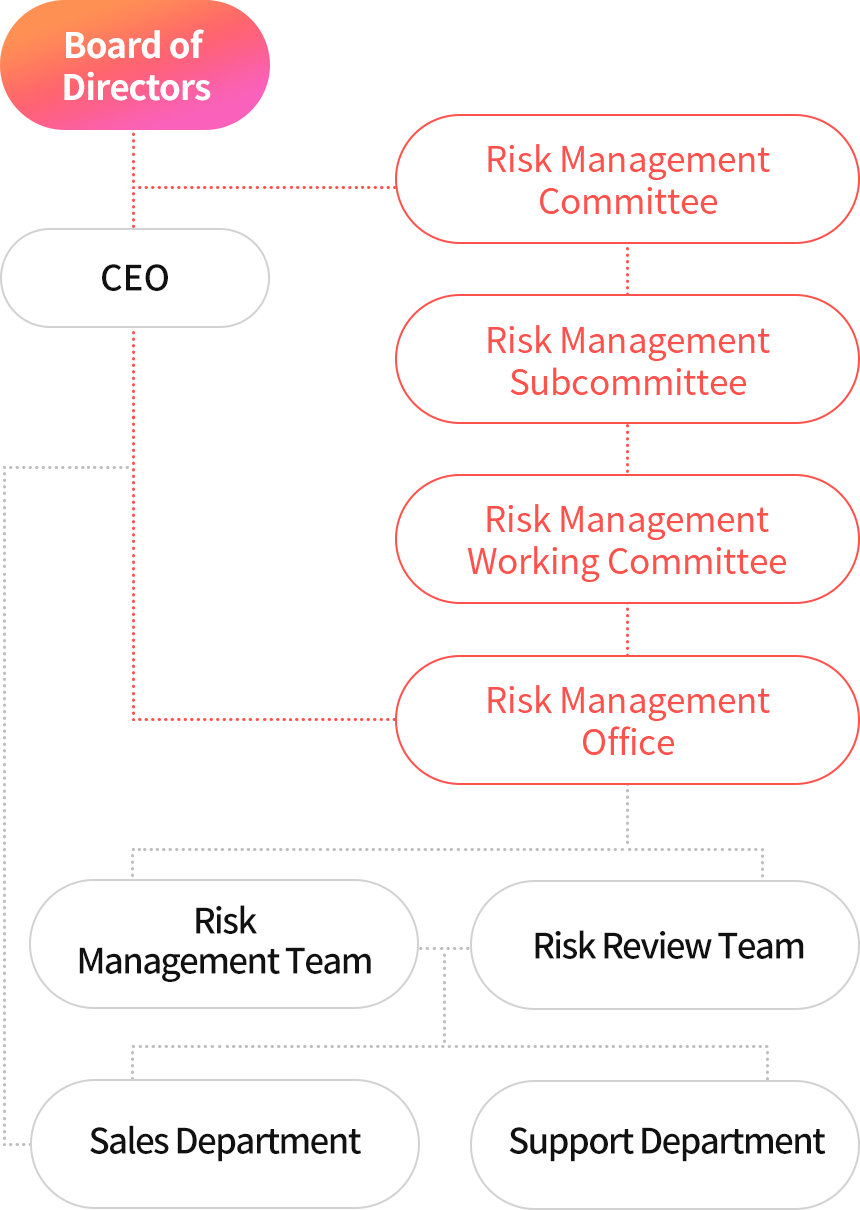

Risk Management Organization

Risk Management Organization

- Establishment of basic risk management policy

- Determination of level of risk that the company can bear

- Approval of appropriate investment limit and loss limit

- Deliberation on approving loans related to PI, PF, and corporate finance in excess of 7% of equity capital (up to KRW 100 billion) at the end of the business year immediately before the current business year

- Approval and supervision of establishment of risk management system (RMS)

- CRO chaired as a sub-organization for appropriate risk management work of the Risk Management Committee

- Deliberation and resolution on all details related to risk management

-

Risk management-related rational decision-making support and professional advice support

(OTC derivatives transaction feasibility review, derivative model review, selection of credit offerings and credit/loan exception review)

Roles and Responsibilities of the Risk Management Department

The domestic financial market is expanding its scope to alternative investment assets such as real estate finance, veering away from the existing investment focus on domestic stocks and bonds. In the case of real estate assets, the investment amount is relatively large, and liquidity is relatively low compared to traditional assets such as stocks and bonds. Therefore, Eugene Investment & Securities has organized a separate team that specializes in real estate review, and it is in the process of strengthening real estate review capabilities.

Risk Management Team

Risk Management Team

Risk Review Team

- Setting the risk level and monitoring

- Evaluate all assets except real estate

- Operation of risk management meeting

- External reporting (NCR, etc.)

- Real estate review

- Real estate asset follow-up

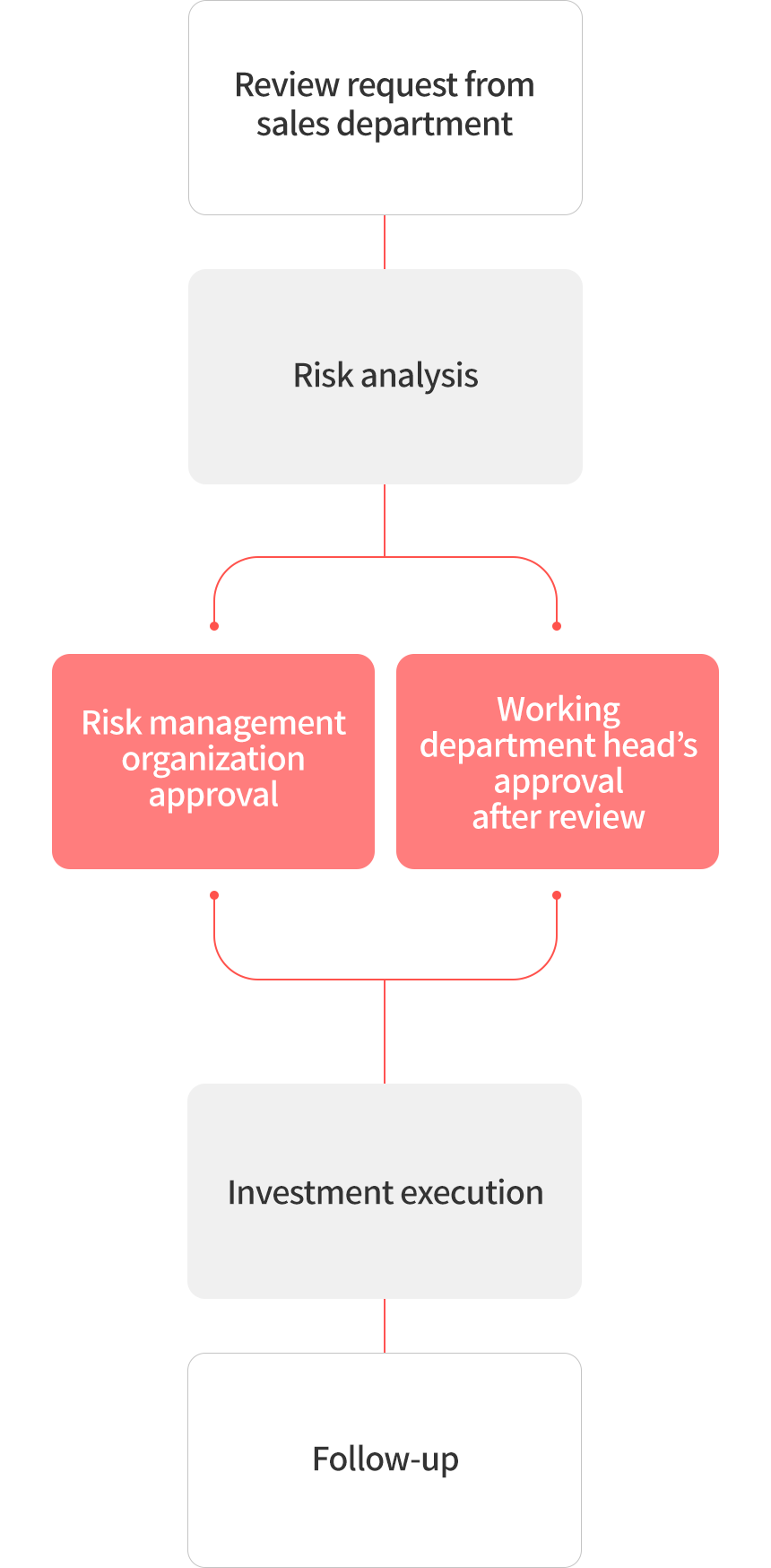

Risk management and audit process